Mauritius Company Documents | Order Documents |

Mauritius Company Document examples

We are able to conduct comprehensive company searches in Mauritius, providing you with copies of all the information held on the target company by the Registrar of Companies.

Mauritius Companies are governed by the Companies Act, 2001 and regulated by the Mauritius Financial Services Commission.

The Mauritius Companies Act 2001 provides confidentiality concerning all matters in relation to companies holding a Category 1 Global Business Licence or a Category 2 Global Business Licence. Therefore, the information included in a Mauritius company search is limited.

| Mauritius Company Documents | ||

|---|---|---|

| Company Search Report | £188 | 3-4 days |

| Expedite fee | £75 | 1-2 days |

| Order |

Mauritius Corporate and Business Registration Department

The Corporate and Business Registration Department is a government department, which comes under the Ministry Of Finance and Economic Development. It administers the Companies Act 2001, the Business Registration Act 2002, the Insolvency Act 2009, The Limited Partnerships Act 2011 and The Foundations Act 2012.

The Companies Division of the Mauritius Corporation and Business Registration department has the following main functions:

- The incorporation, registration and striking-off of Mauritius companies

- The registration of documents that must be filed under the Companies Act 2001

Mauritius Company Search Report

We can provide a Company Search report with the latest filed information from the Mauritius Registrar of Companies, including the legal status of the company, company registration details and the current registered office address.

A Mauritius Company search includes:

- Company/ Partnership Name

- Company/ Partnership Number

- Company Status – Live, Defunct and

- If in process of dissolution/ winding up

- Type of Company – Limited by Shares, Global Business Category 1 (GBC 1), Global Business Category (GBC 2) Licence, Protected Cell Company

- Nature of Mauritius Company – Private,

- Incorporation/Registration Date

- Company Category – Global Business Category 1, Domestic, Category 2 Global Business Licence / formerly International Companies

- Subcategory

- Registered Office Address

- Registered Agent Address and contact details – where available

- Additional details not from the registry – where available

In Mauritius details of directors and shareholdings of private companies are confidential not divulged to third parties without consent. The information is held by the Mauritius Registrar of Companies and the Mauritius Registered Agent.

Companies holding a Category 2 Global Business License are required to maintain financial statements to reflect their financial position and are not required to file accounts with the Mauritius Registrar of Companies.

A company with a Global Business License conducts business outside of Mauritius. A resident Mauritius corporation which conducts business outside of Mauritius may apply to the Financial Services Commission for a Category 1 Global Business License.

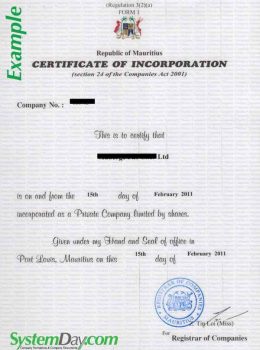

Mauritius Company Documents

We are able to supply registry copies of official company documents, such as the Certificate of Incorporation and the Memorandum and Articles of Association. These documents are issued by the Registrar of Companies and are often required when concluding business contracts, dealing with official governing bodies and when dealing with financial institutions. Due to commercial law in Mauritius company documents are only provided for domestic and public registered companies in this jurisdiction.

With a Global Business Category 2 company the request for copies of documents is made only to the registered agent, director or shareholder of the Mauritius company.

Mauritius Company Formations

The most common forms of incorporation in this country are the Global Business Category 1 (GBC 1) and the Global Business Category 2 (GBC 2).

Companies registered in Mauritius benefit from tax treaties and also their is no capital gains and dividend withholding tax.

Global Business Category 1

GBC 1 companies are considered as resident in this jurisdiction, hence benefit from various Double Taxation Treaties that Mauritius holds.

GBC 1 companies are permitted to trade within Mauritius and with residents, on the condition that prior approval from the FSC is granted.

GBC 1 companies are required to prepare and file annual audited financial statements, in accordance with International Acceptable Accounting Standards, within 6 months following the financial year end. This is in addition to keeping company registers, accounting records, directors’ reports, meeting minutes and other reporting documents at the companies registered office. This information is not available for public inspection.

Once incorporated, GBC 1 entities may be converted into GBC 2 entities.

GBC 1 Directors

- Minimum of two directors

- Must be Mauritius residents – in order to benefit from tax treaties

- Resident company secretary must be appointed

- Must appoint local auditor

GBC 1 Share Capital & Shareholders

- No minimum share capital

- Share capital may be in any currency except the Mauritius Rupee

- Both share of par or no par value are allowed

- Must file corporate shareholder register with the FSC, but this register is not available for public inspection

Global Business Category 2

GBC 2 entities are used for the purpose of holding assets and conducting business outside of Mauritius, they are not considered to be resident in this jurisdiction and therefore do not benefit from the countries double taxation treaties. However, all income generated (provided it is generated outside Mauritius) is completely tax exempt.

GBC 2 Directors

- Only one director is required

- Does not need to be resident in Mauritius

- Details of directors are not available to the public

GBC 2 Share Capital & Shareholders

- Minimum share capital $1

- Share capital may be expressed in any currency except Mauritius Rupee

- Only one shareholder is required

- Shareholder does not need to reside in Mauritius

- Details of shareholders are not available for public inspection

Registry Filing Requirements

All domestic Mauritius companies must file an Annual Return together with accounts.

Mauritius Companies holding a Category 2 Global Business License are required to maintain financial statements but, not required to file accounts with the authorities.

Mauritius Certificate of Incorporation

A Certificate of Incorporation can only be provided for certain company types registered in the Mauritius.

The Ministry issues a copy of the Certificate of Incorporation certifying that a company is incorporated under the Companies Act and:

- Company Name

- Date of Incorporation

- Company Number

- Companies Act